Tesco Ireland Marketing Research Plan

| ✅ Paper Type: Free Essay | ✅ Subject: Marketing |

| ✅ Wordcount: 2201 words | ✅ Published: 17 May 2021 |

Introduction

In the area of €7,6 billion ( € 6 billion), the Irish food demand is currently forecast. The market has three major types of operators: numerous, classes of icons and stand-alone shops. It is a highly competitive industry with over 70 percent of the market being regulated by the top five operators. The CSO forecasts the increase in food sales in 1999 in the range of 7.3%. The growth rate for 2000 is set at 9.2%. Gross margins are improving in the food industry. The average industry in 1987 stood at 16%. This soared to 20% in 1991, with food margins at 22,5% for 1997 the latest statistic visible. It is reported that the operating profit for Irish retailers is between 3.5% and 5.0%. With only 2% of the grocer ‘s stores, three multiples dominate 49% of the sector. In some main regions, the multiples control the food industry, e.g. they have far greater shops than icons or individual operators. In 1998, 46% of the many stores were over 20,000 square metres. In the 10,000-20,000 sq . ft. and 32 percent was. Ft. rank. Category. In addition, fewer than 5,000 sq. is 92% of the symbol shops. Ft. Ft. Ft. Symbol categories, all of which include franchisees, are said to account for 35% of market share in 20% of outlets. Musgrave and BWG are the main symbol classes. Spar and Mace franchises run by BWG, SuperValue and Centra operate by Musgrave. Many such icon categories had a smaller consumer position. There is something in the range of 20 percent market share of the remaining ‘independent independents.’ Allen (2020)

The Irish economy developed faster than any other countries of the OECD in the 1990s and reported the highest rate of growth amongst EU countries consistently. In the 2000 era, GDP growth was nearly 10%. Since the early 1990s disposable incomes have also risen mostly attributable to cuts in personal tax, lower interest rates and higher job rates as well as higher wage levels. In 2001 the annual pay rises are calculated by the IBEC to be 10 percent. Economists point out that the pace of economic development has generated an ever-increasing infrastructural divide, endemic labour, rising inflation, and bursting property prices. The ESRi expects annual average growth of 4.8% until 2005 and 4.3% annually for the next 5 years, while the latest recession is already under way. Allen (2020)

Tesco Ireland

Tesco Ireland belongs to the multinational community of enterprises of Tesco PLC. Established in 1920 in the UK, Tesco has been an inexpensive cheap store over the course of the years. In the 1980s a strategic relocation in the UK industry was started, in order to cope with JS Sainsbury, the then market leader. It has also organically expanded and developed through domestic acquisitions. In the 20-year timeframe up to 1993, the number of shops was decreased dramatically whereas the overall size of the store was drastically increased. The UK food store is currently Tesco’s number five. Its performance is attributable to consumer service, brand penetration and central delivery supply chain efficiencies. The main aim of Tesco is:

Continually increasing value for customers to earn their lifetime loyalty

When it purchased a small 51 percent interest in 3 Guys in 1978, the firm first globally moved to the Republic of Ireland and later withdrawn from the business in 1986. Since then, through purchase, Tesco also grown globally into Hungary in 1994, Poland and the Czech Republic and the Slovak Republics in 1995/96. By 1999 it had an international portfolio of outlets, 91 in France, 75 in the Republic of Irelands, 17 in Thailand and two stores in South Korea, all from central European countries. In March 1997, after Tesco purchased the food retailing interests of the Associated British Foods on Ireland, it returned to the Irish sector. This purchase brought them national representation in the two sections of the island and immediate market supremacy. Upon entry, the business vowed to invest 100,000 kg on recovery and growth of stores. Tesco PLC. (2020) A site-by-site refilling of the Quinnsworth / Crazy price stores was carried out with the operation ended in 2001. All the grocery stores bought were medium to big supermarkets and mostly sold from distribution areas smaller than 25,000 square metres. ft, but there were sales areas at certain sites up to 40,000 sq.ft. Including a strong balance of commercial and rural areas, the shop network was nationwide. When Tesco met the Irish Government, it pledged itself, inter alia, to sustain the procurement of products from Irish manufacturers and to allow Irish goods access to Tesco stores. The organisation also cooperated on the development of the productivity of the industry with Irish farmers and processor classes. In its first year in Ireland, around 90 Tesco Ireland branded products were made. Quinnsworth / Crazy Luxury Preference suppliers have purchased Tesco branded suppliers for a valued valuation of £ 11 million. Any vendors with special or exclusive product lines were able to supply stores throughout the larger Tesco network. At the beginning of 2002, 119 Irish firms had been Tesco brand goods manufacturers on the domestic sector and export markets. In chosen shops of sufficient scale, a promotion was added on non-food , e.g. a selection of clothes, smartphone and hardware, music and films. It updated all purchased shops and searched for new storage locations. The aim was to harmonise the architecture, merchandising and equipment as well as the general environment of all Irish shops. It has spent €300million in the growth of its store to date. In February 1998 the business began a ’employee awareness’ scheme, where 8000 of its Irish workers remained in the United Kingdom on various shopping operations for at least one day. They have began a management twinning scheme for a similar UK shop in all Irish stores. Tesco launched the Irish Clubcard, which now has 700,000 subscribers, almost instantly upon delivery. In the UK, the organisation built an advanced data mining package that facilitated analysis of the sales of clubcards by country, shop, product line or particular form of client. This knowledge has been used for advertising reasons and provides consumers directly. Today, clubcard has five member organisations: ESAT Transparent and ESAT Digifone. Clubcard also has five partner organisations. Tesco integrated the fruit and vegetable distribution during the summer of 1998. Keelings, a Dublin-based company, was named for the supply of goods to the 78 Tesco stores. In their Dublin headquarters all purchasing decisions were held. Tesco acquired a 35 acre warehouse site in North Dublin in May 1999. The warehouse is a centre for Tesco ‘s new, cooled and frozen food delivery in Ireland. The production contract for the Keelings facility was granted later that year (September). Two thirds of Tesco Ireland’s goods are in this repository by number, while Shelflife estimates that 50% of all lines by weight are not yet sold centrally. It then named another firm (Allegro) to sell the products that were not foodstuffed and going slowly. Tesco reported in 2002 that two thirds of all products were shipped from five central depot sites to Tesco’s shops. Tesco PLC. (2020)

Research methodology

Inductivism is an approach for the research focusing on the interpretation of a general lesson dependent on a few assumptions. During analysis with the inductive approach the “environnement” is experienced and expanded. The discovery typically consists of a model which sets out a variable of interest and then develops a hypothesis of general target and behaviour. Since the purpose of this research is not to create new ideas, but rather to increase the understanding of environmental results and different responses, this approach is not enough. Another form of research focussed on the ultimate solution is deductive, implying that a wide set of hypotheses relating to a given hypothesis is restricted to unique theories which can be investigated. In order to adhere in theory to the initial argument, this method requires using the required proof. This technology is thus not suitable for this research since the studies do not think of deductive inference in appropriate depth. It is noted that a policy of abduction centred on divergent resources during a meeting between theories and processes. It is not a deductive or inductive way, but all options are concerned. In order to reconcile the three elements, the abductive argument is used to make the theoretical form, experimental proof and perception flexible. The flexibility determines the partnership between empirical evidence and rational findings in the analysis, since this approach is concentrated on deduction. The abductive approach is thus the strongest in this research, as the investigation incorporates a certain theory with empirical experimentation. The abductive technique facilitates the creation of a theoretical framework in order to describe, explain and add flexibility to the novel phenomenon. This approach would also allow the scientists to apply extreme claims and findings to achieve results in this phase of research. This is primarily targeted at reviewing empirical studies and discovering new results.

This paper looks at learning from a general viewpoint, but it is anticipated that these criteria will be used to illustrate a different collection of more comprehensive goals for potential foreign retail education studies. The data obtained for this case studies often concentrate on the Irish activities of Tesco are recognised.

PRODUCTS – PRIVATE LABEL SUCCESS

“Tesco picks, prepares and packages regular items, from new to fried produce, from luxury bags to gourmet delicacies and from raw foods to ready meals in several different forms.” We are continuously innovating and investing in new lines to expand our consumers ‘ choices … The Tesco Finest line was a big success, launched last February. Tesco PLC. (2020)

“Our Value Brand this year celebrated the 10th anniversary and today’s rates are lower than they were ten years earlier. In the shopping cart of 1993, the price was £19.31 for 41 lines. Today, it is just £12.59, which saves £6.72 or 35%. In a modern theme, we have re-launched our value packaging and added new cookshops, garments, stationery and food. Tesco’s value range currently comprises 1,200 goods and 70 per cent of Tesco consumers are bought from the industry. Tesco PLC. (2020)

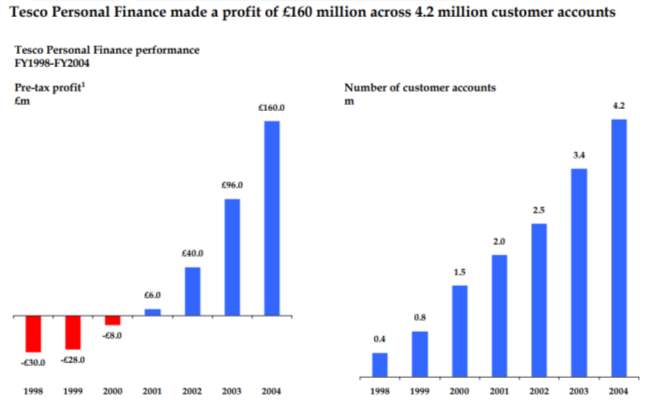

SERVICES – TESCO PERSONAL FINANCE PERFORMANCE

FORMATS – STORE FORMATS

“Tesco shop layouts are planned to fit our consumers’ diverse buying habits. It also allows them versatility to fulfil the updated planning policy criteria. We take the unique requirements of the local community into consideration when planning new stores to ensuring the construction and scenery remain in sync with the surroundings … Improvements in our purchasing and delivery processes now enable us to supply smaller compact stores in locations that were historically difficult to service. Tesco PLC. (2020)

“We customise our shops to suit our clients. Another shopping experience are provided through specifications and all our formats. Our retail portfolio: Extra, Superstore, Metro and Express are all separate outlets, but they all have excellent value. Tesco PLC. (2020)

Future Growth

“We’re not content to be in South America. We were very cautious. We were very careful. In Russia or Indonesia, we haven’t spent. You must pick where you are headed. But we’re pretty pleased with our nation choices, we don’t always get it right. So fine, so good.” Tesco PLC. (2020)

“We’re never saying America never. It’s a wide sector, in certain aspects it’s a strong market. We will obviously take a look at it if we could find the best path. We’re really vigilant and there’s no fantastic past in Britain. But if Tesco is in Europe and Asia, then it would be in the United States one day?

“In 10 or 15 years we don’t want to stay here, claiming that China was a wonderful accomplishment, or what a shame Tesco wasn’t there.” Tesco PLC. (2020)

“The most attractive properties are Dutch retail firms and the US-based activities, which have not been impacted by the accounting controversies, Stop & Shop and Giant. Tesco finds the €10 billion brave commodity of Ahold, the disturbed Nederman supermarket giant whose stocks crumbled 64 per cent last week.”

SWOT Analysis

- Strength

- A vast network of supermarket outlets promotes shopping and market shares for consumers.

- Private label and exclusive domestic goods offer a cheaper, but close, option for consumers to that of popular labels.

- Customers in partnership with Tesco Bank have versatile payment options.

- Weakness

- The inefficiency of participation in certain forms of shopping.

- Innovation deficit contributes to cost containment as the primary technique for improving net profits.

- Opportunities

- Sales from online channels increase. Actually, consumers are able to purchase and supply food items on the Tesco platform as quickly as possible on the same day of order.

- Expand the booker brand to places like Brazil that proved popular with a cash and carry format.

- Threats

- The implications of Brexit would impact the supply chain and profits of Tesco in Europe.

- The Irish food sector has been won over by discounted shops like German Aldi and Lidl.

Conclusion

Tesco is a pioneer in the supermarket industry in Ireland in spite of heavy rivalry. Controversies in limited but more lucrative lines – cress, general goods and catering revenues from Booker, have compensated for the heavy trade in Tesco’s main food sector. Tesco ‘s financial perspectives for the last fiscal year are solid enough to sustain a 50% compensation ratio and are estimated to climb to 59%. Tesco plans to sell GBP 8.2 million in its Thai and Malay activities and would target the cash on the Irish market. This transition will strengthen the company’s financial structure but will decrease opportunities for success. It’s important to know what average and long-term effect Tesco will have of the latest plan for consolidation and cutting costs.

References

Allen, C. (2020). Tesco: Company Outlook. Bloomberg Intelligence.

Tesco PLC. (2020). Annual Report and Financial Statements 2020.

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal